Award-winning PDF software

Reg 256, statement of facts - california dmv

Other than for income tax and GST purposes, that is, for purposes of calculating the taxable value of the asset, the sale is taxable under the Taxation Administration Act. However, the GST/HST at 15% would apply to the taxable benefit because the transfer occurs between related persons. For further details on the GST/HST, refer to the GST/HST Info Sheet, GST/HST Information for Businesses. For more detailed information on the GST/HST, refer to the GST/HST Info Sheet, GST/HST Information for Small Businesses.

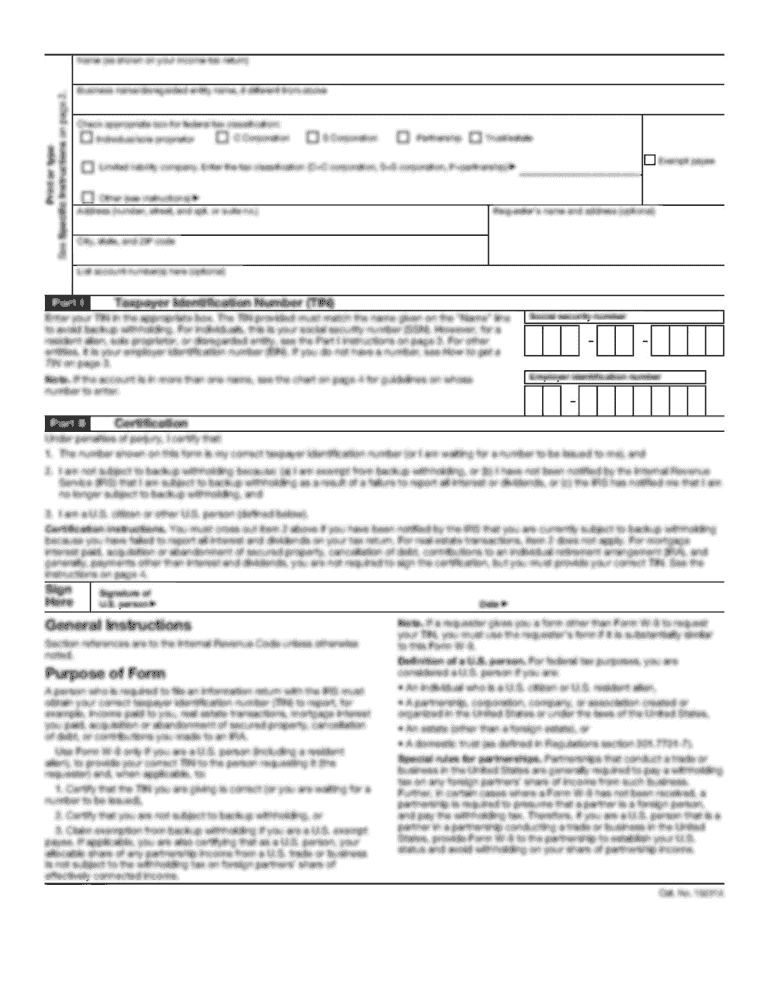

Form reg256 "statement of facts" - california - templateroller

Is available on the California DMV Website at If you have not previously completed a California driver's license, driver's permit or registration form, you will need to go to a DMV office and complete the online California DMV Driver's License/ID Replacement Form (REG 256 Form). For general information about the California DMV's online processes see the article from the California DMV Website entitled, “California DMV online services,” which can be found here: You can also download a copy of the REG 256 for free on the California DMV Website here: . To have your Statement of . . . Sent to you: In person: For any type of driving instruction you can use either the online process which was described in the REG 256 Form, or By mail: The address for processing your online driver's license/ID replacement is: Driver's License/ID Replacement Department of Motor Vehicles 500 Commonwealth Avenue, Suite 200 Sacramento, CA 95814 or Department of Motor Vehicles 500 Commonwealth Avenue, Suite 250 Sacramento, CA.

Reg 256 - fill online, printable, fillable, blank | pdffiller

Cents on the dollar. The California DMV Form Reg 256 has to have a 1,000 exemption (this amount is the maximum amount that can be removed each year before the California taxable value is reduced by the 250 vehicle registration fee, which is the basis for the vehicle assessment). The amount of this exemption cannot be paid with any money (cash or bank deposits/bills) or any other tangible item. If we were to list all exemptions under this code, that would mean all taxes had to be paid all over again! The other form that I recommend for exempting the use tax is the California Vehicle Exemptions Form. I have one for everyone! I am not sure if there are any exemptions still on the California DMV form. Here are some more tips for having a successful California vehicle transfer and car assessment exemption process to avoid paying any California Vehicle.

Fillable form reg 256 (2008) | edit, sign & download in pdf

The REG 256 will help you get your vehicle title transferred to you. You will receive a copy of the REG 256 when you complete the registration process with your local DMV office. You can find DMV agents near you that can assist you with REG 256 form completion. Please note, if your vehicle has not been registered before, you'll need to complete a REG 256. California Vehicle Title Transfer REG 256 Register or transfer an old vehicle to the DMV to transfer ownership.

Get ca dmv reg 256 2008-us legal forms

Online DMV can't replace your local DMV branch but can create your official state identification card. Online DMV lets you check your identification, get your birth certificate, or renew your driver's license. It saves you money and the time of visiting your local DMV. Online CA DMV online Complete your registration and ID cards by mail or in person. Get your current and new ID card online with CA DMV online form or mail it in. Print and mail your CA ID card to your local CA DMV office. It's as simple as selecting your county. Online Complete California ID card online Find your CA ID card by name and description Find your old CA driver's license or identification card by name. Use the name you used when you first signed it. We will use this same form to show you our records and compare your current card with your old card. Online Complete your registration online Online registration.